Here’s another acronym that you should know: CAC

The Completing Apprenticeship Commencements (CAC) is a new Australian Government wage subsidy that is designed to complement the Boosting Apprenticeship Commencements (BAC) wage subsidy.

In its simplest form, CAC is geared to help employers that have received the BAC incentive to retain their apprentices and trainees, by offering:

- a 10% wage subsidy (up to a maximum of $1,500 per quarter) in their apprentices or trainees’ second year, and;

- a 5% wage subsidy (to a maximum of $750 per quarter) in their third year.

Key Messages for Employers:

- If you commence an apprentice or trainee on-or-before June 30, 2022, you may be eligible for both the BAC and CAC wage subsidies.

- For those employers who already have a BAC place for their current apprentices and/or trainees, you’ll be automatically rolled over onto the CAC wage subsidy.

How the CAC wage subsidy works:

- CAC is paid quarterly in arrears, in the same way that the BAC subsidy has been paid.

- Apprenticeship Support Australia issues claim forms at the end of each standard quarter that employers may be eligible for.

- Employers will be required to provide us with payroll evidence in order to lodge their claims.

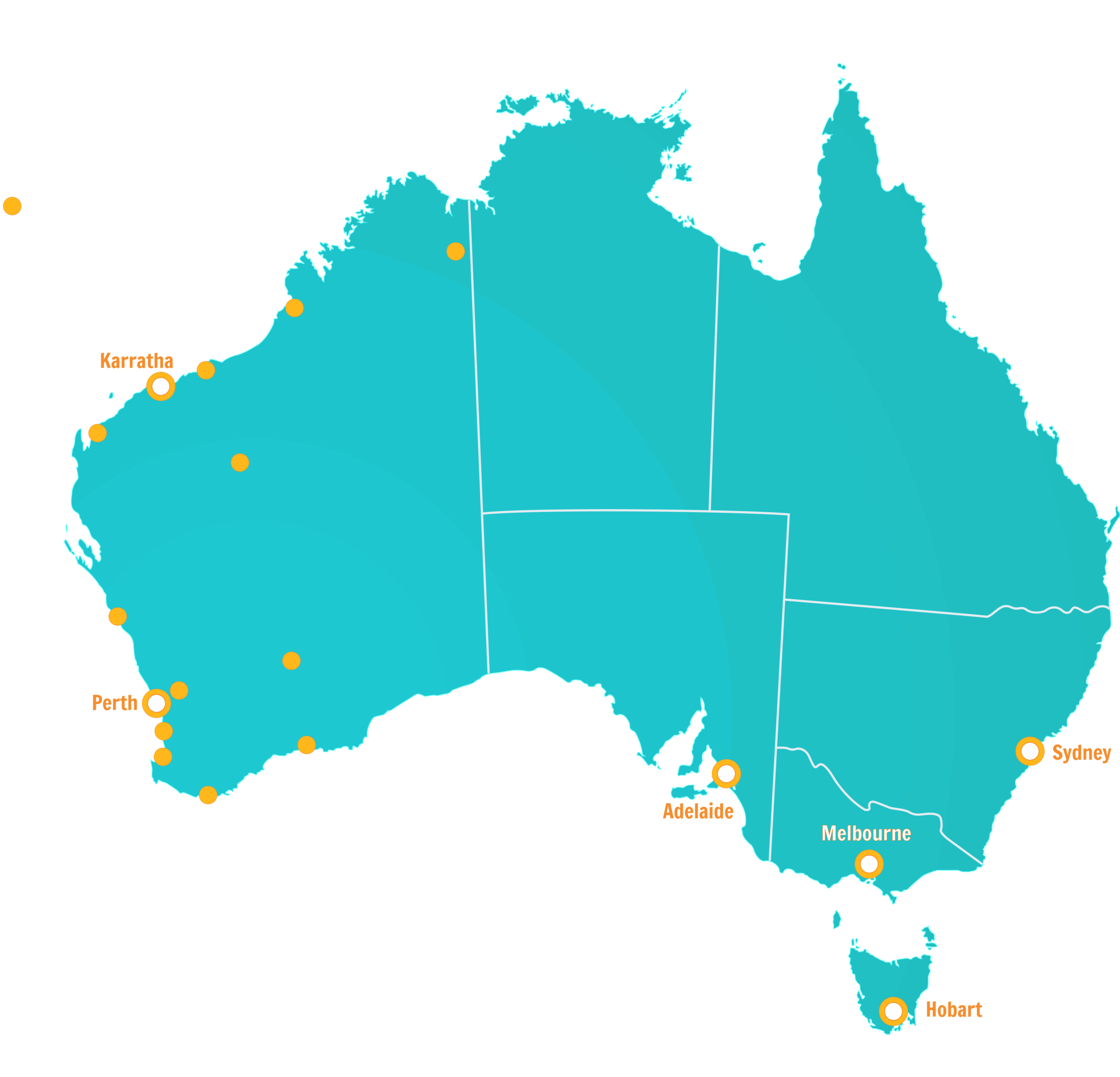

The BAC and CAC wage subsidies are available to employers of any size, industry or geographic location.

For more information, read the BAC and CAC Fact Sheet here >

Contact ASA for more details about how you can include apprentices or trainees into your business, on 1300 363 831 or [email protected].